Our Philosophy

At Totally, we passionately belive that everybody deserves to learn how to build wealth and unburden themselves financially, maximizing their chance to live a long and happy life.

Our goal is to provide an easy and intuitive way to make complex, critical financial decisions. Our mission is to Totally unify the otherwise siloed worlds of investing for retirement, real estate, career planning, and education.

Most of us learn by doing. Our free tools are designed to empower by distilling complex financial modeling techiques into simple tools to enable smarter, more transparent decisions. We incorporate contextual education, meaning that anybody can learn new concepts using numbers that are directly applicable to their unique situation. We encourage folks to get hands-on and play around with different what-if scenarios to easily understand their impact to their biggest financial decisions.

A handful of pivotal decisions overwhelmingly determine your wealth potential and are key happiness drivers:

We break these decisions into a system of interconnected tools, designed to help you choose smarter:

Tools

trending_up

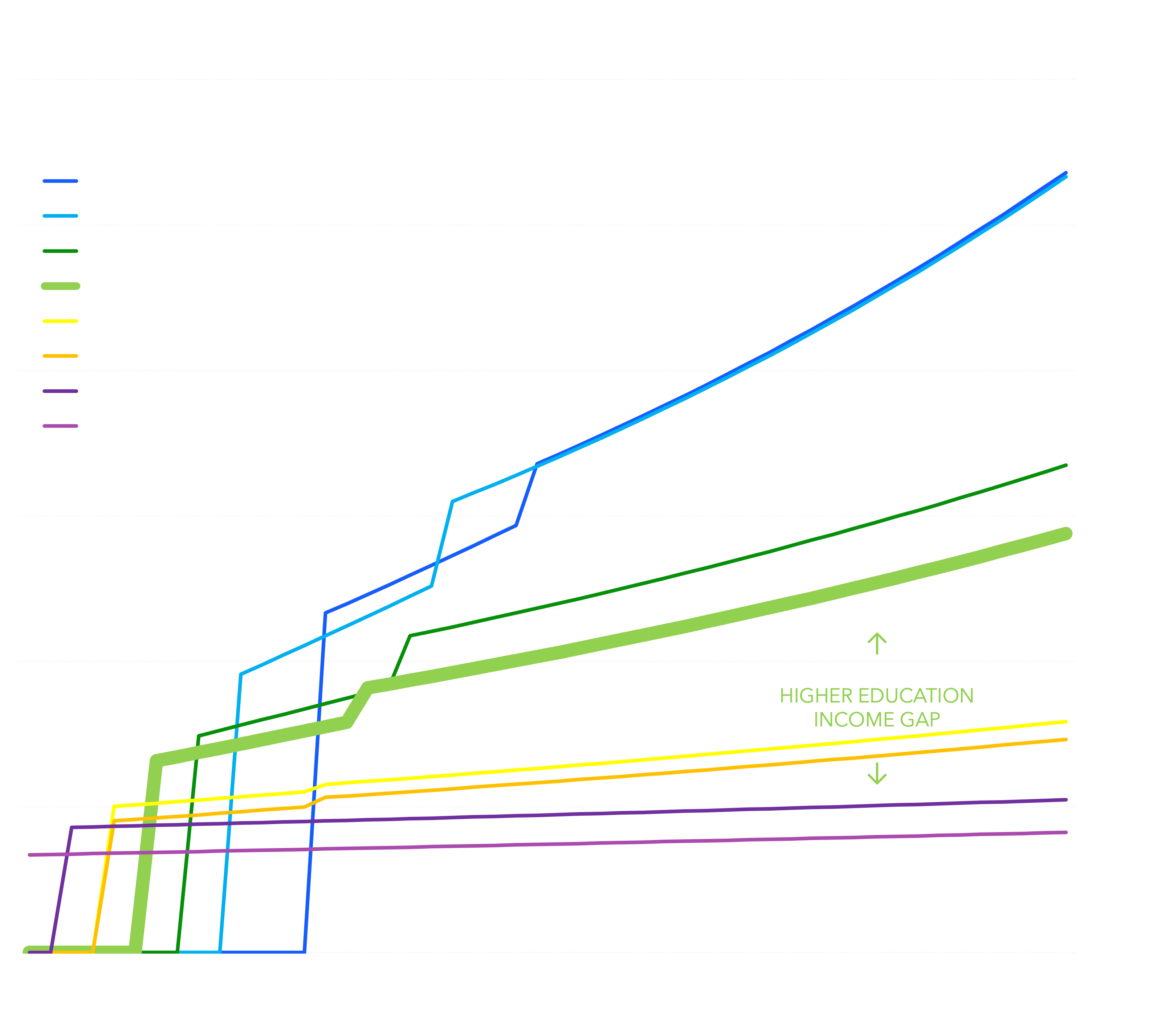

Invest for the long term, and stay the course. Leverage the power of compounding to watch your money grow. Don't let FOMO lead you astray. Avoid fads, bubbles, and meme stocks. Stick to low cost, risk-optimized, diversified, time-tested strategies. Invest early and invest whatever you can reasonably spare.

school

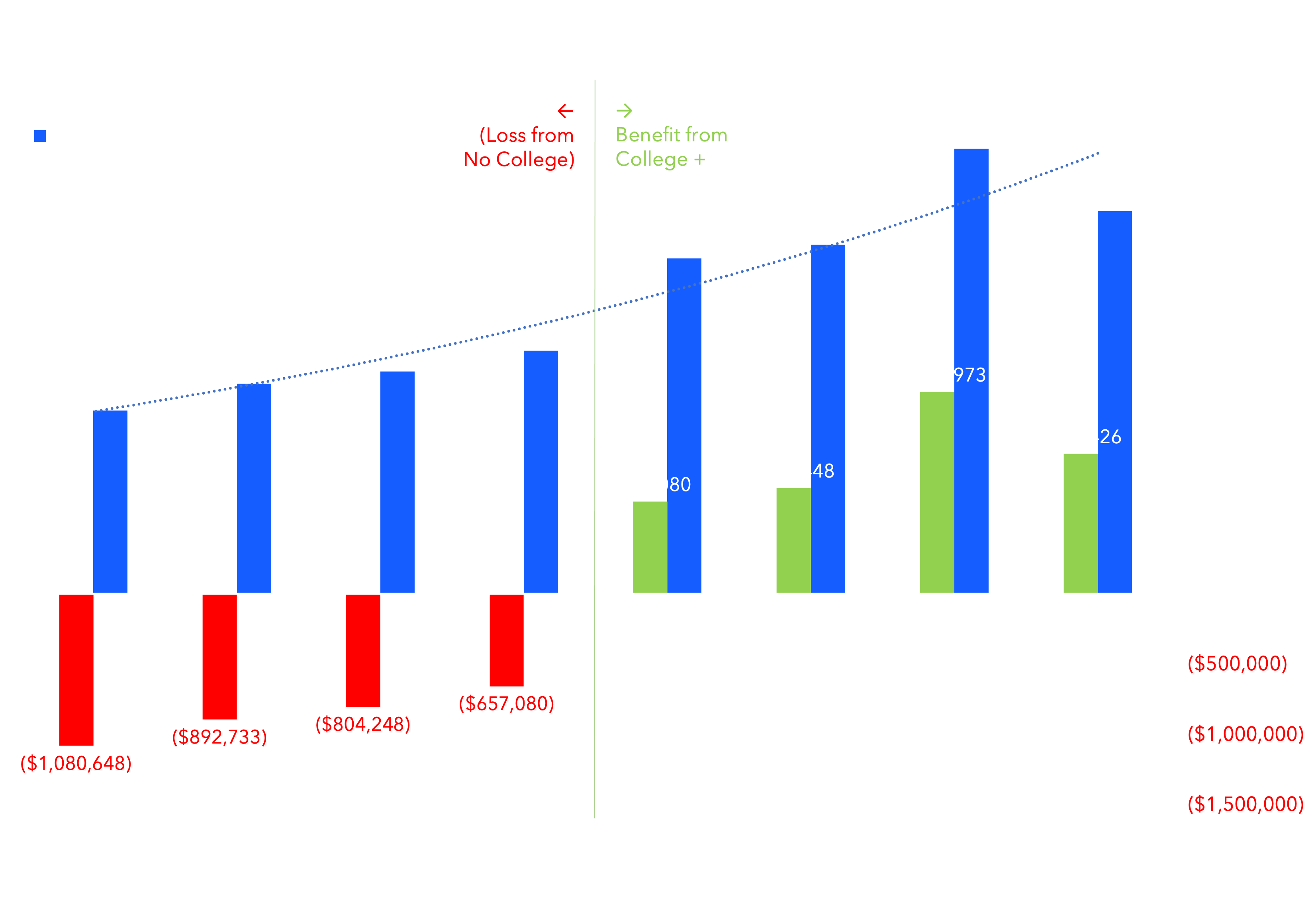

Build your "human capital" early and often. Finish high school, go to a college that makes sense for you. Only go to grad school if you have a career plan, and find a career path with upward mobility. Don't get in your own way: be open minded about how to make the most of your skills and talents, and see you can translate them into a profitable industry and role. Try to find an employer who pays in the top quartile for your job family, and/or be entrepreneurial where you can.

Dispelling common myths

zoom_out

False. There is nothing more selfless than a financially stable home and providing for your family's needs. And when possible,

retiring earlier allows you to spend more of your best years with the people and activities that bring you joy. Building wealth is about Prospering: enabling freedom, flexibility, and maximizing happiness.

zoom_out

False. You need to

make the right decisions in real estate to build wealth. In fact, an ill-informed purchase of personal or investment property can leave you in far worse financial health, lacking liquidity for unplanned large expenses or opportunities, or becoming "house poor." Especially while home prices and interest rates are sky high, for many households the most in wealth-building decision will be to rent.